ERP software is typically used by larger businesses while accounting software is more suited for small businesses. It’s important to note that the cost of accounting software can vary greatly, so it’s important to compare different systems and plans to find the best fit for your business. You can choose a basic system and add à la carte options such as project management or CRM, or you can choose an all-in-one system that includes everything you need. As a small business owner, you have the option of hiring an accountant, recording transactions by hand or using an accounting software to record your business transactions. This is a necessary chore that helps small business owners track and manage their money effectively – especially during the early stages.

Accounting is the process of keeping track of your business’s financial transactions. This is the act of tracking and reporting income and expenses related to your company’s taxes. You don’t want to be in a situation where you have to pay more income tax than is normally required business accounting by the Internal Revenue Service (IRS). Tax professionals include CPAs, attorneys, accountants, brokers, financial planners and more. Their primary job is to help clients with their taxes so they can avoid paying too much or too little in federal income or state income taxes.

What Is Business Accounting? (And How to Manage Yours)

Potential investors, stakeholders, or buyers will expect accounting records vetted by a CPA (Certified Public Accountant) that prove your business is profitable and on track for growth. Up-to-date financial statements are essential if you want to fund your small business with a loan. Credit accounting involves analyzing all of a company’s unpaid bills and liabilities to make sure that a company’s cash isn’t constantly tied up in paying for them. Accounting software can help you generate financial statements easily, or you can have a bookkeeper do it for you.

It’s actually a full-featured, double-entry accounting system that happens to offer an exceptional user experience. For these reasons, it’s an Editors’ Choice winner and is one of the first accounting options a small business should consider. It’s intuitive enough for novice bookkeepers to learn but supports all the elements that a larger business would need, including payroll. There are three financial statements that all small businesses should consider creating. Katherine Haan, MBA is a former financial advisor-turned-writer and business coach. When she’s not trying out the latest tech or travel blogging with her family, you can find her curling up with a good novel.

Best for Inventory Tracking

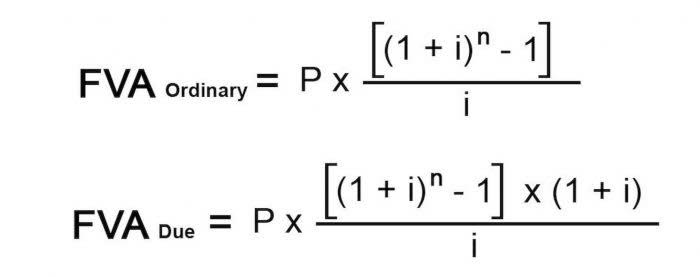

The difference between these two accounting methods is the treatment of accruals. Naturally, under the accrual method of accounting, accruals are required. Accountants may be tasked with recording specific transactions or working with specific sets of information. For this reason, there are several broad groups that most accountants can be grouped into.

- Additionally, sign up for any available free trials to evaluate the software.

- When setting up a small business accounting system, you need to choose a method of recording financial transactions.

- The Internal Revenue Service also requires consistency for the purpose of filing small-business taxes.

- This efficiency translates to tangible savings, with the potential to cut monthly client management costs significantly.

- Its $78 per month Established plan comes with everything in the Growing plan, but also lets you track projects, use multiple currencies, claim expenses and view in-depth data analytics.

- Accounting is how a business organizes, records and interprets its financial information.

You do the same thing for the products and services you buy and sell, so you can add them easily to transactions. It’s an excellent choice for anyone who already uses other Zoho software and businesses that plan to grow. Features include client management, multilingual and recurring invoicing, expense and mileage tracking, and reports. You can import bank and credit card statements but can’t set up direct connections to your financial institutions.

What Is Accounting? The Basics Of Accounting

Small business accounting is done by recording all of the income and expenses your company generates and using that information to make forecasts, generate invoices, complete payroll, and file taxes. A good small business accounting service gives you information that helps you answer these questions based on the input you supply. Instant search tools and customizable reports help you track down the smallest details and see overviews of how your business is performing. Mobile apps and websites give you access to your finances no matter where you are. Recently, the company added an $8-per-month charge for scanning expense receipts, which puts a dent in its appeal, though it’s still an excellent service that gives you a lot for free.

The profit and loss statement and statement of cash flows cover a particular time period, such as a quarter or a calendar year. A balance sheet is a snapshot of a business’s assets and liabilities as of a particular date. You may follow generally accepted accounting principles or a different standard. Whichever you use, it’s important to understand the basics — even if you have small-business accounting software. That way, you can have productive conversations with your financial advisor or accountant.

Simple Numbers, Straight Talk, Big Profits! 4 Keys to Unlock Your Business Potential

The software is also a good fit for service-based businesses, such as consultants, web designers and photographers. If you have five or fewer clients, you can sign up for FreshBooks’ Lite plan for $19 per month. The plan includes unlimited expense tracking, unlimited estimates, accept credit cards and bank transfers, track sales, see reports and send unlimited invoices to up to five clients. Accounting for small businesses is done by keeping a complete record of all the income and expenses and accurately extracting financial information from business transactions.