Content

When performing financial analysis, operating cash flow should be used in conjunction with net income, free cash flow , and other metrics to properly assess a company’s performance and financial health. This is an important measurement because it allows investors and creditors to see how successful a company’s operations are and if the company is making enough money from its primary activities to maintain and grow the company. This concept is particularly important for financial forecasting because it can help show the health of a company. For the last few years of their operations, they were losing money on all of their retail activities, but they were making money on maintenance contracts and customer financing. “Net Cash Flow” shall not be reduced by depreciation, amortization, cost recovery deductions, or similar allowances, but shall be increased by any reductions of reserves previously established. In the past, your accounting department would use a double-entry general ledger and T-accounts to keep track of debits and credits.

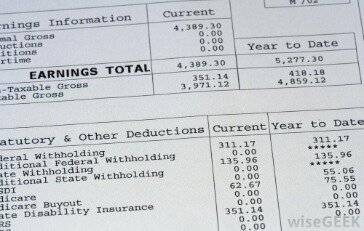

There are two formulas to calculate Operating Cash Flow – one is a direct method, and the other is an indirect method. It’s important to use data from the same accounting period — otherwise, you risk inaccurate results. 70% of small businesses are optimistic about their finances — both now and in the future. Yet for nearly 30% of SMBs, running out of cash is the top cause of failure. Our starting point is net income, which is pulled from the income statement.

AccountingTools

Depreciation and amortization are non-cash expenses that are used to account for the cost of assets over time. Depreciation On The Income StatementDepreciation is a systematic allocation method used to account for the costs of any physical or tangible asset throughout its useful life. Its value indicates how much of an asset’s worth has been utilized. Depreciation enables companies to generate revenue from their assets while only charging a fraction of the cost of the asset in use each year. Below is an operational activity financial statement through which we have to calculate Operating Cash Flow.

It is calculated by taking the net income, adding non-cash expenses such as depreciation or amortization, and adjusting for any changes in working capital. By looking at the operating cash flow, you can get how efficiently the business is operating and if it has the necessary resources to meet its financial obligations. This way, it is important to pay attention to the operating cash flow to keep track of the financial health and stability of a company. The indirect method of calculating operating cash flow is used to adjust net income from an accrual basis to a cash basis.

What Are the 3 Types of Cash Flows?

It represents the amount of cash flow available to all the funding holders – debt holders, stockholders, preferred stockholders or bondholders. Business acquisitions, particularly leveraged buyouts, are another area in which operating cash flow data may have predictive value. Since the ability of an acquired company to contribute heavily to service debt is a critical factor in many acquisition decisions, operating cash flow and related measures may be useful in identifying potential targets. The model contained the six conventional accrual-based financial ratios mentioned earlier.

Operating cash flow refers to the cash your business generates from its normal operations. Essentially, it shows how much cash flow you’ve made without taking secondary sources of revenues, such as interest or investments, into account. To have accurate numbers on these components, you need to know where to find those on financial statements, namely, the cash flow statement. Usually, the cash flow statement starts with the Cash Flow from Operating Activities section, and you’ve got everything you need there. Overall Operating ExpenseOperating expense is the cost incurred in the normal course of business and does not include expenses directly related to product manufacturing or service delivery.

Operating cash flow vs net income

Therefore, a Operating Cash Flow in inventory must be added back to net income. As you can see, this OCF formula much more complicated, but it gives much more information about the company’s operations. It’s essentially converting the operating section of the accrual income statement to a cash basis statement. This calculation is simple and accurate, but does not give investors much information about the company, its operations, or the sources of cash. That’s why GAAP requires companies to use theindirect methodof calculating the cash flows from operations.

Investing cash flow includes all purchases of capital assets and investments in other business ventures. Financing cash flow includes all proceeds gained from issuing debt and equity as well as payments made by the company. Operating cash flow is a measurement of the amount of cash brought in by a company’s normal business operations. Essentially, operating cash flow shows if a company is generating enough positive cash flow to sustain and grow its operations. If the company cannot generate enough positive cash flow, then it may need external financing for capital expansion. Operating cash flow is an important metric that can give you plenty of insights into a company’s financial health and ability to meet its obligations.

Explore Business Topics

Operating cash flow is important because it lets creditors and investors see the success of a firm’s operations and if it’s making enough cash to maintain itself and grow. When it comes to financial forecasting, this calculation is relevant, as it can show the company’s health. Businesses that offer net terms to their customers can create a cash flow crunch if their costs need to be covered before customer payment is received.

Why Is Operating Cash Flow Important?

Operating cash flow is an important benchmark to determine the financial success of a company’s core business activities as it measures the amount of cash generated by a company’s normal business operations. Operating cash flow indicates whether a company can generate sufficient positive cash flow to maintain and grow its operations, otherwise, it may require external financing for capital expansion.