Content

The primary guidelines your organization should know about are the GAAP standards. Fund accounting enables nonprofits to allocate their money into different groups or “funds” in order to keep them organized and only spend funds on what they’re designated for. When you first started working at your nonprofit, what entranced you?

The IRS provides this handy questionnaire to help you figure out exactly which parts of the tax code apply to your organization, and which form you’ll use to apply for tax-exempt status. For the most part, nonprofits can apply to the IRS to become exempt from federal taxes under Section 501. Once you’ve got a bookkeeping system in place, you need to start creating financial statements. Looking at these documents can tell you how much money you have, where your money is, and how it got there. At The Charity CFO, we handle the books and all of your accounting needs. It’s like having an in-house team dedicated to your organization, without the overhead cost of a full accounting department.

Best for Small Organizations

We’re honored that over 120 nonprofits trust us with their bookkeeping and accounting. And we’d be excited to show you how we can help your organization meet your goals. Bookkeeping for some small nonprofits may be as simple as creating invoices for donations received and paying salaries and day-to-day expenses. That’s why we recommend most nonprofits work with a payroll processing service rather than trying to do it themselves. On top of that, nonprofit bookkeeping requires staying updated on income tax changes and filing requirements to ensure compliance. Because while nonprofit bookkeeping and accounting are related, they’re not the same thing.

- An in-kind donation or a gift in kind represents a donation of goods or services instead of money for purchasing goods and services.

- And we’d be excited to show you how we can help your organization meet your goals.

- If you’re not satisfied with your purchase and no longer intend to use it, the company will give you a full refund.

- As part of your cash flow report, you need to account for any restricted grants so they can be separated in the cash accounts.

- Nonprofit accounting professionals must adhere to specific guidelines when they create reports.

- All of this happens while ensuring a steady stream of donations in an increasingly competitive nonprofit environment.

- You can always ask your bank about your account options and use those tailored for nonprofits.

- This would be an in-kind donation, viewed differently than a cash donation by the IRS.

Most organizations will also need to track payments they are owed (accounts receivable), bills that they haven’t paid (accounts payable). Gail Sessoms, a grant writer and nonprofit consultant, writes about nonprofit, small business and personal finance issues. She volunteers as a court-appointed child advocate, has a background in social services and writes about issues important to families.

Aplos Can Save You Time Managing Your Books

For large or growing organizations who need comprehensive accounting services, this program can be a good fit. Driven by donations, nonprofit organizations face unique challenges when it comes to accounting. According to Charity Navigator, Americans donated over $410 billion to charitable organizations in 2017. With so much money passing through, nonprofits have to meet the strict standards and guidelines established by the Financial Accounting Standards Board. Electing an in-house treasurer or financial officer, one who knows how to do bookkeeping for nonprofits, is essential. Furthermore, familiarity with financial software, such as QuickBooks, makes it easier to track purchase orders, in-kind donations, statements of activities, etc.

Does QuickBooks charge per payroll?

QuickBooks Online Premium Payroll

QuickBooks Online Payroll Premium Payroll plan costs $75/month + $8/per employee and includes everything in the Core Payroll plan, plus: Same-day direct deposit. HR support.

For example, whoever is responsible for collecting donations shouldn’t be the same person updating your financial statements. Performing internal audits on a regular basis is an excellent way to keep everything in-check as well. Sometimes foundations or businesses will https://www.bookstime.com/nonprofit-organizations match any contribution made by employees with a grant. Nonprofits must also track these types of donations so the funds can be matched. Instead of prioritizing sales, nonprofits must demonstrate an appropriate use of assets and resources for charitable purposes.

How We Work With Nonprofits

It gives a view of a nonprofit’s prosperity over a period of time, expressing revenue minus expenses and losses. Now is the perfect time to use nonprofit bookkeeping services to ensure your financial records and policies are set up correctly. Plus, since you likely have a limited team, it helps to outsource your bookkeeping so you can focus on growing your organization and never get behind. Bookkeeping involves recording and analyzing a nonprofit’s financial transactions to ensure compliance with state and federal accounting rules.

The basis for an accurate bookkeeping and accounting system is recording all financial transactions. Another aspect of nonprofit accounting that helps organizations stay accountable to their finances is the nondistribution constraint. Unlike for-profits, nonprofits are required not to distribute their net earnings to the leaders at the organization. We rely on our Nonprofit Suite team for our specific reporting needs, month end close, 990 preparation and overall management of our audit process. But we love that we can also go to them for project work related to budget planning, special analysis, and even help with staffing gaps.

How Arizona Gives Day Raised $6.1 Million with Neon One

A nonprofit’s statement of financial position is similar to a for-profit’s balance sheet. Unlike for-profits, a nonprofit does not have ‘equity’ but ‘net assets.’ Net assets are left after subtracting liabilities from assets. We will reconcile your bank accounts to prepare your balance sheet, income statement and other financial reports upon request, as well as advise you on how to read your reports. If you’re ready to take your nonprofit’s bookkeeping capabilities to the next level, let’s have a discussion to determine how we best can collaborate through our outsourced bookkeeping and accounting services. These financial reports provide essential information for your finance committee to rely upon during its quarterly, biannual or annual meetings to make high level decisions about the future of your organization. As part of your cash flow report, you need to account for any restricted grants so they can be separated in the cash accounts.

In those cases, nonprofit bookkeeping includes creating accurate invoices (that account for and collect any required sales tax) to track every sale. Nonprofit bookkeeping is the process of entering, classifying, and organizing financial data for the purpose of creating accurate financial records for your organization. Furthermore, nonprofit bookkeeping differs in some critical ways from for-profit bookkeeping too.

Financial Edge by Blackbaud

If you have not chosen accounting software, need help comparing accounting software features, or think you need to brush-up or train members of the team, a good bookkeeper can take care of that for you. Compare the data in each account against what you have in your books. Reconciling accounts should be a regular activity to track cash flow, identify fraudulent activity, and ensure accuracy.

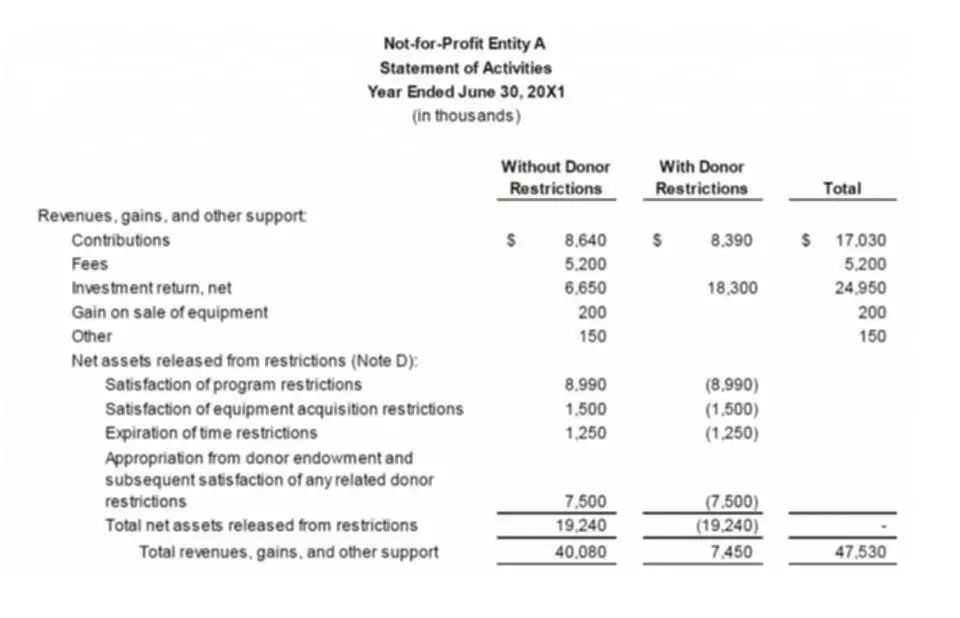

Bookkeeping for a nonprofit takes away from fundraising, spreading awareness, and meeting with potential partners. However, bookkeeping and accounting remains crucial to a nonprofit’s success. While you’re a champion for a great cause, you and your team may be less than heroes regarding how to do bookkeeping for nonprofits. The statement of activities (also sometimes called the operating statement) is like the nonprofit version of the income statement. Like the income statement, it tells you how “profitable” your NFP was over a given period by showing your revenue, minus your expenses and losses. Many accounting software programs allow you to generate financial statements automatically, such as a statement of financial position.

A nonprofit has different goals as compared to other business types, but a need for an operating budget remains. An operating budget is an overview of operations, usually done quarterly or annually, that projects expenses and income. Similarly, nonprofits have rules regarding how money is spent, necessitating a tracking system. A purchase order tells you how much you ordered, what you paid, and when a supplier agreed to deliver goods and services. All of our bookkeepers are US-based, Quickbooks ProAdvisor certified, and experts in nonprofit accounting.