Contents:

At the point they are used, they no longer have an economic value to the organization, and their cost is now an expense to the business. Figure 1.1 Graphical Representation of the Accounting Equation. Both assets and liabilities are categorized as current and noncurrent. Also highlighted are the various activities that affect the equity of the business. Graphical Representation of the Accounting Equation© Rice University is licensed under aCC BY-NC-SA license.

Sales revenue is an account name normally used when a retailer sells an item. Fees earned is an account name commonly used to record income generated from providing a service. In a service business, customers buy expertise, advice, action, or an experience but do not purchase a physical product. Consultants, dry cleaners, airlines, attorneys, and repair shops are service-oriented businesses. The fees earned account falls into the revenue category. He borrows $500 from his best friend and pays for the rest using cash in his bank account.

Access Check

These may include loans, accounts payable, mortgages, deferred revenues, bond issues, warranties, and accrued expenses. For a company keeping accurate accounts, every business transaction will be represented in at least two of its accounts. For instance, if a business takes a loan from a bank, the borrowed money will be reflected in its balance sheet as both an increase in the company’s assets and an increase in its loan liability. The accounting equation is also called the basic accounting equation or the balance sheet equation.

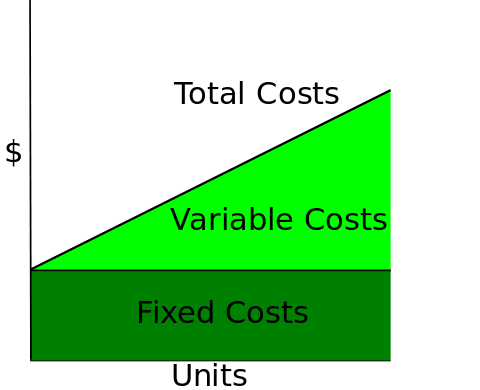

Revenues are what any given business earns from its product or service. Expenses are what it costs the business to operate and provide the aforementioned product or service. The relationship between revenues and expenses is simple. If revenues are greater than expenses, the business makes a profit.

Resources for Your Growing Business

This is the dollar value of resources taken out of the company by the owner for personal use. Unearned revenue from the money you have yet to receive for services or products that you have not yet delivered is considered a liability. Obligations owed to other companies and people are considered liabilities and can be categorized as current and long-term liabilities. The two basic elements of a business are what it owns and what it owes. Working capital indicates whether a company will have the amount of money needed to pay its bills and other obligations when due.

- At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

- For example, if you have a house then that is an asset for you but it is also a liability because it needs to be paid off in the future.

- The accounting equation states that the amount of assets must be equal to liabilities plus shareholder or owner equity.

- Cash, accounts receivable, inventory, prepaid insurance.

You will learn about other assets as you progress through the book. Let’s now take a look at the right side of the accounting equation. This equation must balance because everything the entity owns has to be purchased with something, either a liability or owner’s capital. Assets refer to items like inventory or accounts receivable. Examples of liabilities are bank loans or accounts payable.

Common Applications for the Accounting Formulas

He is the sole author of all the materials on AccountingCoach.com. Distributions to ownersdecreasethe value of the organization. Investments by ownersincreasethe value of the organization. So, every dollar of revenue an organization generates increases the overall value of the organization. We’ll further define and discuss revenues on this page.

For every transaction, both sides of this equation must have an equal net effect. Below are some examples of transactions and how they affect the accounting equation. Journal entries often use the language of debits and credits . A debit refers to an increase in an asset or a decrease in a liability or shareholders’ equity. A credit in contrast refers to a decrease in an asset or an increase in a liability or shareholders’ equity. Shareholders’ equity is the total value of the company expressed in dollars.

From the Statement of Stockholders’ Equity, Alphabet’s share repurchases can be seen. Their share repurchases impact both the capital and retained earnings balances. Regardless of how long it takes to produce and sell inventory, inventory is alwaysconsidered to be aA) current asset.B) current liability.C) long-term asset. Liabilities are amounts of money that the company owes to others.

If something is off, research your https://1investing.in/ documents to make sure all transactions are accurate in your records. The global adherence to the double-entry accounting system makes the account keeping and tallying processes more standardized and more fool-proof. Total all liabilities, which should be a separate listing on the balance sheet. The major and often largest value asset of most companies be that company’s machinery, buildings, and property. These are fixed assets that are usually held for many years. Assets include cash and cash equivalentsor liquid assets, which may include Treasury bills and certificates of deposit.

If revenues are less than expenses, the business incurs a loss. To understand the significance of the equation, first we must explore the meaning of the three words; assets, liabilities and capital. These terms are often used in accounting but can have very different meanings. To ensure that a company is “in balance,” its assets must always equal its liabilities plus its owners’ equity.

The accounting equation shows on a company’s balance that a company’s total assets are equal to the sum of the company’s liabilities and shareholders’ equity. In double-entry accounting or bookkeeping, total debits on the left side must equal total credits on the right side. That’s the case for each business transaction and journal entry. As a result, the financial statements are in balance. This article gives a definition of accounting equation and explains double-entry bookkeeping. We show formulas for how to calculate it as a basic accounting equation and an expanded accounting equation.

Notes receivable is similar to accounts receivable in that it is money owed to the company by a customer or other entity. The difference here is that a note typically includes interest and specific contract terms, and the amount may be due in more than one accounting period. In using the expanded accounting equation, if two of the three components are known, the third can easily be calculated by using some simple Algebra to rearrange the equation. Don’t worry, you’re not going to get an Algebra Lesson.

Put another way, it is the amount that would remain if the company liquidated all of its assets and paid off all of its debts. The remainder is the shareholders’ equity, which would be returned to them. The accounting equation is a concise expression of the complex, expanded, and multi-item display of a balance sheet. Locate the company’s total assets on the balance sheet for the period.

Parallel recovery of chromatin accessibility and gene expression … – Nature.com

Parallel recovery of chromatin accessibility and gene expression ….

Posted: Tue, 04 Apr 2023 07:00:00 GMT [source]

accounting equation‘s capital or equity is the investment or capital the owner has in the firm. The basic accounting equation is less detailed than the expanded accounting equation. The expanded accounting equation shows more shareholders’ equity components in the calculation. The accounting equation relies on a double-entry accounting system.